African Start-up Funding Recovers, Turns to Debt

African Start-ups See Mixed Results in First Half of 2025

The first half of 2025 has brought some positive developments for African start-ups, with increased access to funding from global investors. However, the way this funding is being structured is shifting, indicating a more cautious approach by investors.

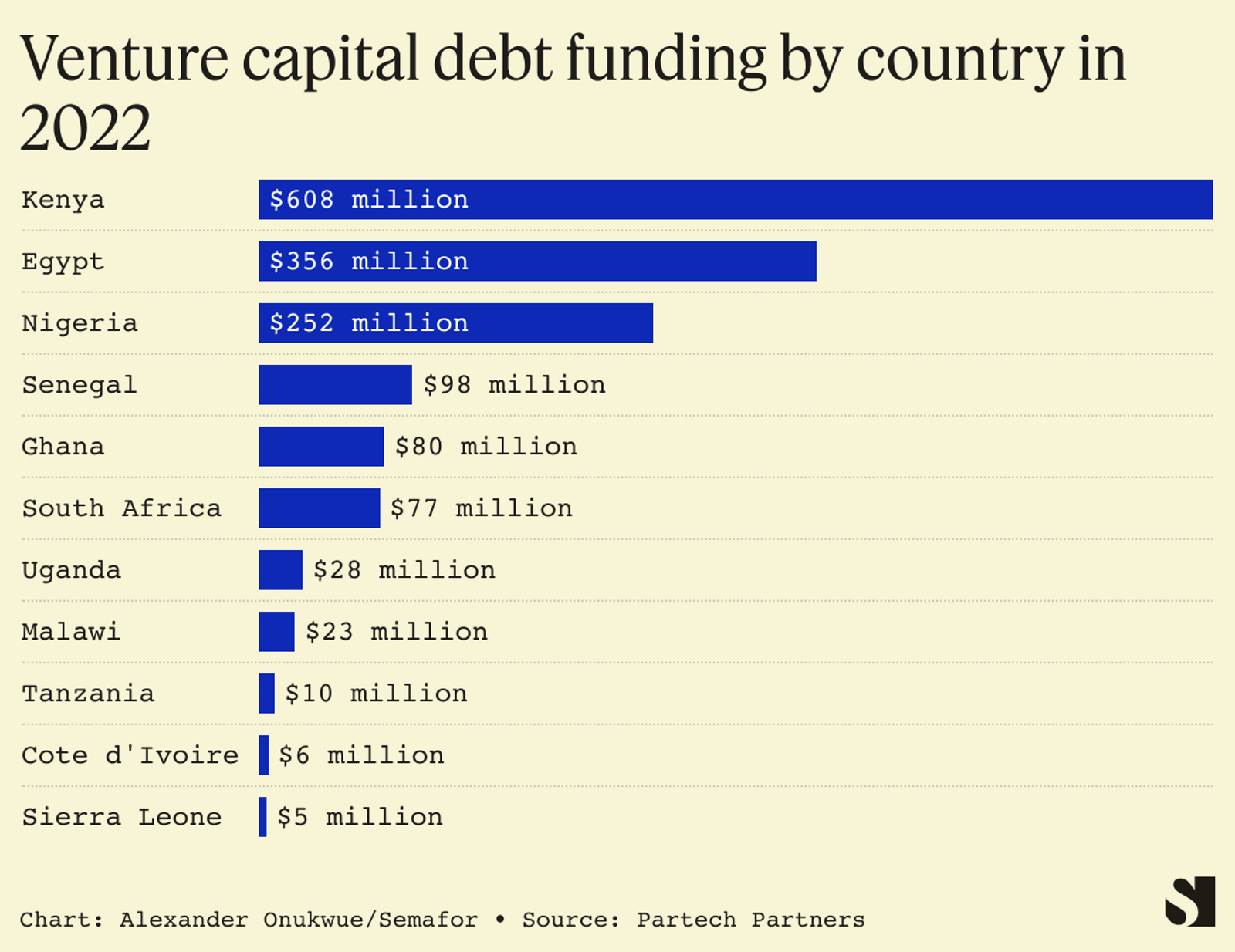

According to data from the Africa Venture Capital Association (AVCA), venture capital funding for African start-ups rose by 50% in the first six months of 2025, reaching $1.2 billion compared to $800 million in the same period in 2024. A significant portion of this funding came in the form of venture debt, which accounted for 80% of the total amount raised. This shift highlights a growing trend where start-ups are increasingly relying on debt financing rather than traditional equity investments.

The number of deals also saw an increase, rising from 205 in 2024 to 239 in 2025—a 11% growth. East Africa contributed significantly to this growth, with 22% of the deals—worth around $144 million—taking place in the region.

Despite these improvements, the rise in debt financing comes with its own set of challenges. For the first time in history, venture debt has surpassed the value of equity deals, creating tighter conditions for start-up founders. Mercy Kimalat, CEO of the Association Start-up and SMEs Enablers of Kenya (Assek), pointed out that the lack of regulatory predictability in Africa makes it difficult for founders to plan for business growth effectively.

“Debt is very frustrating because the regulation landscape in Africa lacks the predictability, hence founders are unable to financially plan for their business growth,” Kimalat said. She added that the pressure to repay debt within a stipulated period can be overwhelming, especially when there are other liabilities to manage.

The data shows that $971 million of the $1.2 billion raised was in the form of debt, more than double the $428 million recorded in the same period in 2024. This marks a significant departure from the traditional dominance of equity over debt. The AVCA noted that this trend mirrors global private capital industry trends, where venture debt has grown by 14% between 2018 and 2024.

Start-ups that received debt funding attracted more value than those that got equity injections, according to AVCA data. However, equity funding often comes with shared risk, pushing firms to seek revenue generation measures quicker to meet repayment deadlines.

The average deal value also increased by 31%, from $5.9 million to $7.7 million. However, the value of debt deals more than doubled, from $14 million to $33 million. While most equity deals were below $3 million, the bulk of the funding growth came from a few high-value transactions, largely in the financial technology sector.

Debt dominated the high-value transactions. Out of the 239 deals, only 29 were debt deals, accounting for 12% of the total but representing 80% of the funding value. This indicates that investors are willing to provide more support to African start-ups, but prefer debt over equity.

The AVCA notes that the directional shift towards a cautious but credible recovery is clear. Deal volume is recovering faster than deal value, and while activity remains well below historic highs, the ecosystem is beginning to find its footing.

Last year was one of the worst for African start-ups, with funding for early to mid-stage companies slumping to the lowest since 2020. This was partly due to global economic crises, tax hikes, political tensions, and unrest on the continent, which led to reduced funding for key innovation hubs like Kenya, Nigeria, and South Africa.

Some experts argue that the shift to debt is also driven by a wave of start-up closures and collapses across the continent, which has made investors more cautious. Kimalat believes that institutional funders’ priorities are changing, negatively impacting African start-ups.

Another key trend this year is the rise in early-stage start-ups. Seed capital deals, the first major round for a start-up, accounted for 80% of the increase in the number of transactions closed. Seed funding rose 40% year-on-year, reaching $171 million in the first half of the year, returning the segment to a comfortable one-third share of overall deal activity.

Financial technology, information technology, and industrial start-ups have dominated funding raises this year, with firms in these sectors accounting for 62% of the total money raised.

While the first half of 2025 shows some optimism, the AVCA cautions that the ecosystem is still settling into a new baseline. Sustained investor engagement in the second half of the year could reinforce the slow but steady recovery observed so far.

Comments

Post a Comment