Gov Acquires 10% Stake in Major US Firm as Trump Unveils Manhattan Project

Trump Announces U.S. Government's 10% Stake in Intel

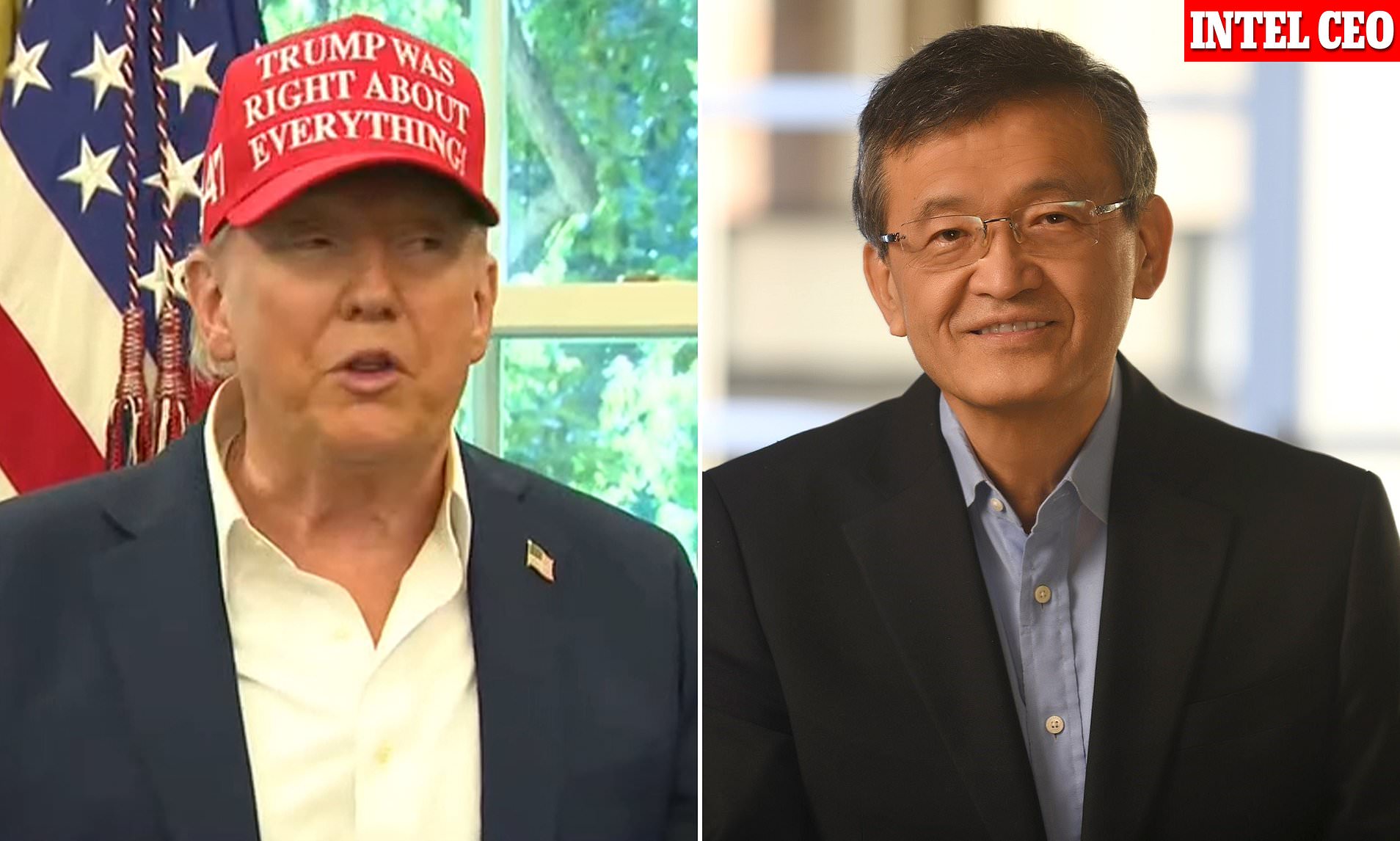

President Donald Trump has confirmed that the U.S. government has agreed to acquire a 10% stake in Intel, the largest chip manufacturer in the United States. This move comes after months of discussions between the company and Washington regarding potential government involvement in the firm. Trump announced the deal on his social media platform, Truth Social, emphasizing its significance for national security and economic interests.

The president stated, “It is my Great Honor to report that the United States of America now fully owns and controls 10% of INTEL, a Great American Company that has an even more incredible future.” He highlighted that the deal was negotiated with Intel’s CEO, Lip-Bu Tan, and noted that the U.S. did not pay any money for the shares, which are now valued at approximately $11 billion.

This development marks a significant shift in the relationship between the public and private sectors. If finalized, the U.S. government would become one of Intel’s largest shareholders, blurring the lines between the two entities. The move is part of a broader strategy by the Trump administration to strengthen the U.S. semiconductor industry and reduce reliance on foreign manufacturing, particularly in Taiwan.

National Security Concerns and Strategic Implications

Trump has expressed concerns about Intel’s financial performance under Tan’s leadership and the country’s dependence on TSMC, a major chipmaker based in Taiwan. The president has been vocal about the need to bolster domestic chip production as part of his trade war efforts against China. By reducing reliance on overseas fabrication plants (fabs), he believes the U.S. can maintain its technological edge in the race to develop artificial intelligence.

The decision to take a stake in Intel also reflects broader national security considerations. Experts have raised concerns about the implications of the government becoming a major shareholder in a critical technology firm. MIT AI computer scientist Dave Blundin compared the situation to the Manhattan Project, stating that it is as important as the space race or the nuclear arms race.

Economic and Industry Impact

Intel’s recent struggles have been well-documented. The company lost nearly $19 billion last year and another $3.7 billion in the first half of this year, prompting cost-cutting measures such as reducing its workforce by 25%. Tan expects the company to have around 75,000 employees by the end of the year.

Despite these challenges, the U.S. government’s investment could provide a much-needed boost to Intel’s operations. The company has benefited from the Biden administration’s CHIPS and Science Act, but it has not been able to fully capitalize on the program’s incentives. Commerce Secretary Howard Lutnick criticized the $2.2 billion in funding Intel received as a “giveaway” that could be better used to acquire shares in the company.

Historical Precedents and Future Outlook

While rare, the U.S. government has previously taken significant stakes in companies during times of crisis. One notable example was the 2008 financial crisis, when the government injected nearly $50 billion into General Motors, acquiring a 60% stake. However, the government eventually sold its shares at a loss.

Lutnick emphasized that the government will not interfere in Intel’s operations, as it will hold non-voting shares. However, some analysts speculate that the financial ties between the administration and Intel could influence other companies to increase their orders for the firm’s chips.

Questions About the Future

As the U.S. government takes a larger role in the semiconductor industry, several questions remain. Will this investment help Intel regain its position as a leading chipmaker? Could it reshape the global tech landscape? And what long-term effects will this partnership have on the balance between public and private interests?

With the stakes high, the outcome of this deal could have far-reaching consequences for the U.S. economy, national security, and the future of artificial intelligence.

Comments

Post a Comment