Xiaomi Reclaims Top Spot in Southeast Asia Smartphone Market After 4 Years

Xiaomi's Dominance in Southeast Asia's Smartphone Market

Xiaomi has emerged as the leading smartphone vendor in Southeast Asia for the first time in four years, capturing 19% of the market with 4.7 million units sold during the second quarter. This achievement marks a significant shift in the region’s competitive landscape, as the Chinese tech giant surpassed both its domestic rival Transsion and global player Samsung Electronics. According to Canalys, Xiaomi’s success is attributed to strong sales across both budget and premium handsets, despite broader market challenges.

The company’s performance was particularly notable given the downturn in Southeast Asia’s smartphone market, which experienced a 1% year-on-year decline. Factors such as looming tariff uncertainties and macroeconomic pressures have dampened consumer confidence, leading some vendors to struggle. However, Xiaomi managed to navigate these challenges effectively, driven by strategic expansion and innovation.

Strategic Expansion and Brand Growth

One key factor behind Xiaomi’s growth was its efforts to expand its sales channels, enabling it to scale its sub-brands. The budget brand Poco saw its shipments more than double, while sales of the premium 15 series increased by 54% year on year. This marked a milestone for Xiaomi, which has long been associated with budget-friendly devices but is now making inroads into the premium segment.

Additionally, Xiaomi leveraged the rapid growth of TikTok Shop, the e-commerce platform of the short video app. By selling lower-priced online-exclusive models and clearing older inventory through aggressive discounts and live-selling events, the company found a new avenue for growth. This strategy not only boosted sales but also helped Xiaomi maintain a competitive edge in an increasingly digital marketplace.

Market Position and Regional Competition

In the second quarter, Xiaomi overtook Transsion and Samsung, which held 18% and 17% of the market, respectively. While other major players like Oppo and Vivo faced declines—shipments dropping by 19% and 21% respectively—Xiaomi remained resilient. The company’s focus on value-conscious customers allowed it to maintain steady growth, even as the broader market slowed down.

Honor, a spin-off from Huawei Technologies, also saw a surge in shipments, increasing by 121% compared to the same period last year. However, it did not make it into the top five brands in the region. In contrast, Xiaomi was the only one among the top five brands in mainland China to record growth in shipments during the second quarter, with a 3.4% increase to 10.4 million units.

Financial Performance and Diversification

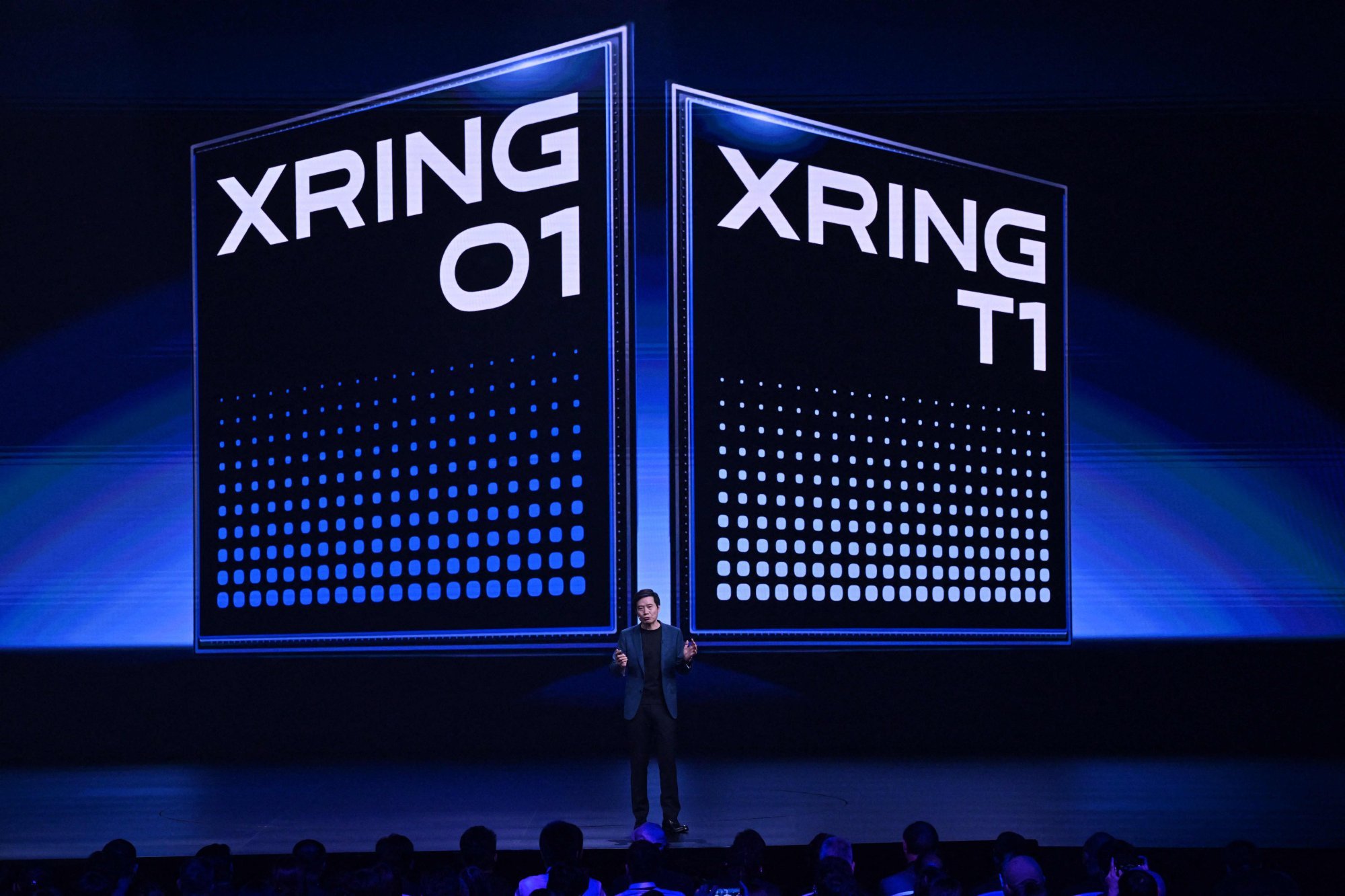

Xiaomi’s success extends beyond the smartphone market. The company has expanded into highly competitive sectors such as electric vehicles and semiconductor design, mirroring its early successes in these fields. This diversification has contributed to its overall financial strength.

For the three months ending March 31, Xiaomi reported a nearly 50% surge in revenue to 111.2 billion yuan (US$16.46 billion). Adjusted net profit also rose significantly, reaching a record high of 10.68 billion yuan, reflecting the company’s growing profitability.

Conclusion

Xiaomi’s dominance in Southeast Asia highlights its ability to adapt and innovate in a challenging market. By focusing on affordability, expanding its distribution channels, and leveraging digital platforms, the company has solidified its position as a key player in the region. As competition intensifies and market conditions evolve, Xiaomi’s strategic approach will likely continue to shape its future growth.

Comments

Post a Comment